Medicare Advantage (Part C) Plans

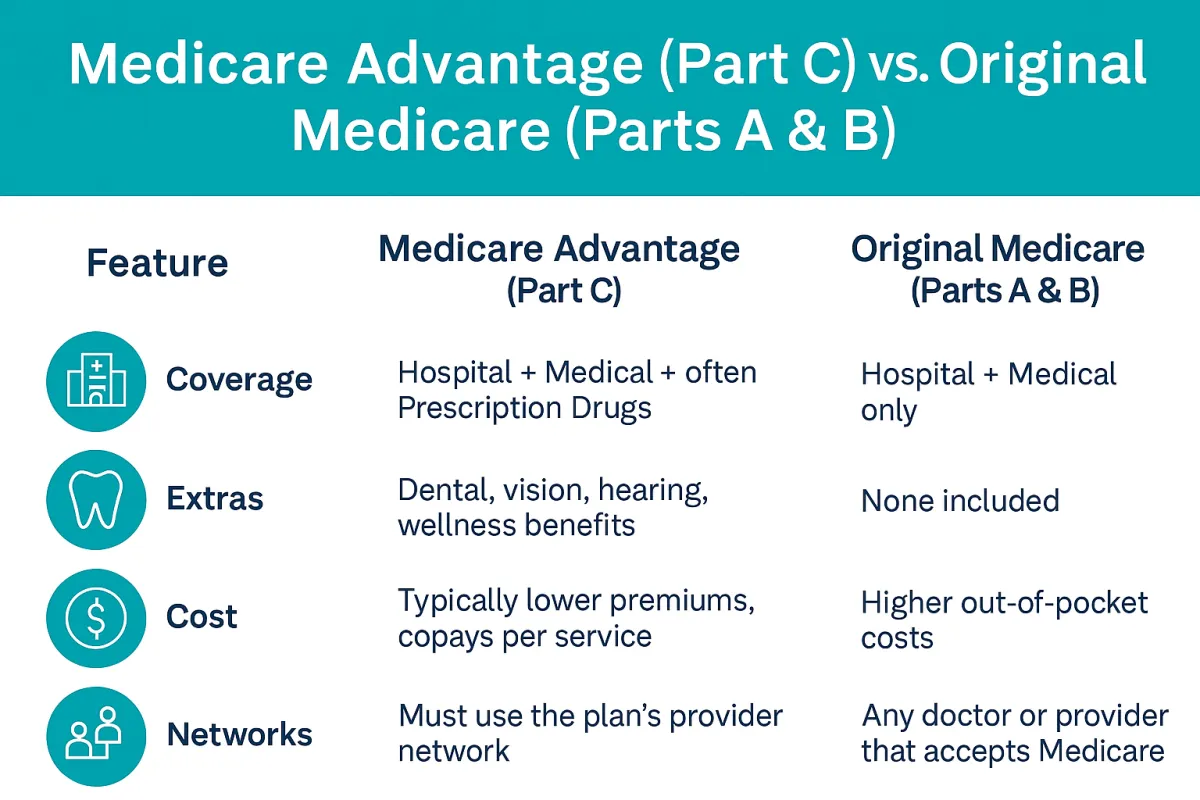

Medicare Advantage, or Part C, provides an all-in-one alternative to Original Medicare.

Offered through private insurance companies, these plans combine hospital and medical coverage while frequently including extra benefits not found in Original Medicare.

Many Medicare Advantage options also add prescription drugs, dental, vision, hearing, and wellness programs, making them a popular choice.

Why Choose Medicare Advantage?

✔ Combines hospital, medical, and often drug coverage into one plan

✔ Many include dental, vision, and hearing benefits

✔ Convenient: one card for all your healthcare needs

✔ Lower monthly premiums—sometimes $0

How It Works

When you enroll in a Medicare Advantage plan, your private insurance provider becomes your main coverage instead of Original Medicare. Most plans are HMO or PPO networks and use a pay-as-you-go system with copays for services.

Typical Copays:

• Hospital stay: $350/day

• Outpatient surgery: $250

• CT Scan/MRI: $200

• Specialist visit: $50

You’ll still need to pay your Medicare Part B premium, but many find the extra benefits and lower monthly costs worth it.

Pros & Cons

Advantages:

• Extra coverage (dental, vision, hearing, prescriptions)

• Lower monthly premiums

• Wellness perks like gym memberships

• Out-of-pocket maximums for financial protection

Considerations:

• Limited provider networks (especially with HMOs)

• Copays and coinsurance can add up

• Some treatments may require pre-authorization

Ready to Explore Your Options?

Choosing between Original Medicare, Medigap, and Medicare Advantage can feel overwhelming—but you don’t have to decide alone.

Copyrights 2024| Insurance Market Advisors™ | Terms & Conditions